In a groundbreaking development, media entrepreneur Byron Allen, renowned owner of The Weather Channel, has made an audacious move with a staggering $30 billion offer for Paramount Global, encompassing both debt and equity. This strategic play aims to reshape the landscape of media ownership and has already sent shockwaves through the industry.

Media Tycoon’s $30 Billion Bid for Paramount Global

Byron Allen’s Bold Offer and Bloomberg’s Insights

Bloomberg News broke the story, detailing Allen’s impressive $14.3 billion bid to acquire all outstanding shares of Paramount Global. This bid, if successful, could mark a significant shift in the power dynamics of the media and entertainment sector. Move aside, David Ellison, as Byron Allen emerges as a formidable player in this high-stakes game.

Allen Media Group’s Official Statement

Allen Media Group confirmed the offer, emphasizing that it believes the $30 billion proposition, inclusive of debt and equity, is the optimal solution for Paramount Global shareholders. The statement, emailed to Reuters, underscores the seriousness of Allen’s bid, urging stakeholders to consider and pursue this compelling opportunity.

The Intricacies of Allen’s Offer

Strategic Intent and Potential Divestitures

Reports suggest that Allen’s modus operandi involves selling Paramount’s film studio, real estate, and intellectual property while retaining control over linear networks, Paramount+, and streamlining operations for enhanced efficiency.

Financial Landscape and High Stakes

With Paramount+ expenses soaring to $6 billion in the nine months ending September 2023, and adjusted OIBDA at -$1.17 billion, Allen faces a challenging financial landscape. His bid comes at a time of continued high-interest rates, adding complexity to the potential deal.

Industry Dynamics and Paramount Global’s Response

Paramount Global’s Market Position

As of Tuesday, Paramount Global’s market capitalization stood at $9.13 billion, coupled with a debt load exceeding $15 billion. The traditional media giant, home to Paramount Pictures, CBS, Nickelodeon, MTV, and other major assets, grapples with the evolving media landscape and the rise of streaming services.

Allen Media Group’s Strategic Position

Allen Media Group, with assets like The Weather Channel, local TV stations, and themed cable channels, positions itself as a formidable contender in this bid. The statement from Allen Media Group emphasizes their commitment to the best interests of Paramount Global shareholders.

Byron Allen’s History and Chess Game Strategy

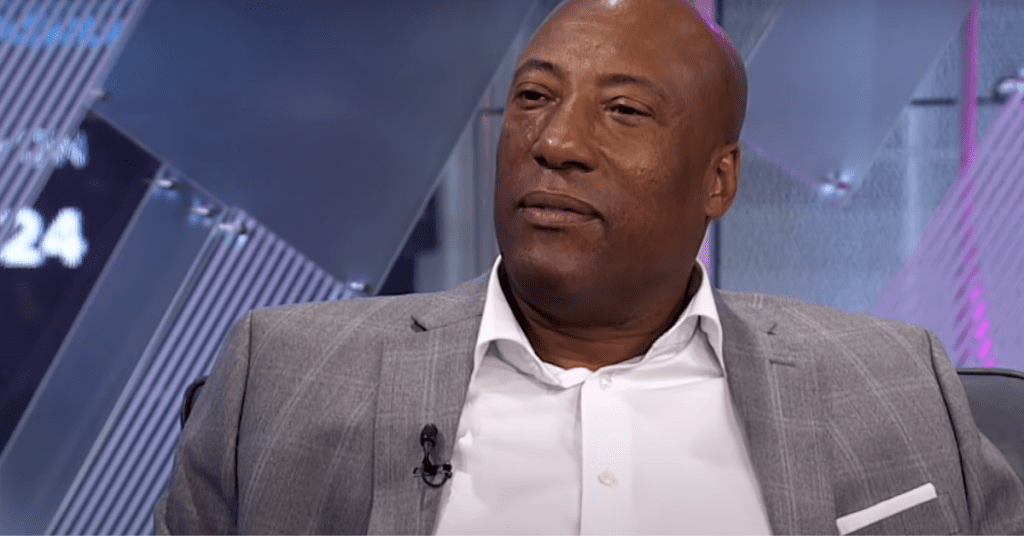

A Closer Look at Byron Allen

Byron Allen, a former stand-up comedian turned media mogul, is renowned for his strategic acumen and aggressive negotiation tactics. His chess-like approach to business, described by Eddie Murphy, involves patience and precision, making him a force to be reckoned with in the industry.

Past Engagements with Paramount

This isn’t Allen’s first encounter with Paramount. In March of the previous year, he, along with Tyler Perry and Sean “Diddy” Combs, explored acquiring BET from Paramount, showcasing his persistent interest in the media landscape.

In conclusion, Byron Allen’s $30 billion bid for Paramount Global signifies a pivotal moment in media history. As the industry awaits Paramount Global’s response, the outcome of this high-stakes bid could reshape the future of media ownership and influence.

Read: Sirius Aviation’s Hydrogen-Powered VTOL Jets: Revolutionizing Air Travel

1 thought on “Byron Allen’s $30 Billion Bid Shakes Paramount Global: A Media Power Move”