In recent interviews, financial guru Robert Kiyosaki has been making waves by declaring what he believes is the imminent end of the American empire. Holding up a dollar bill, he refers to dollars as fiat money and counterfeit, urging followers to explore alternative assets. Is this a red flag we should be paying attention to, or is it just another prediction in the ever-evolving world of finance?

Robert Kiyosaki’s Warning Signs

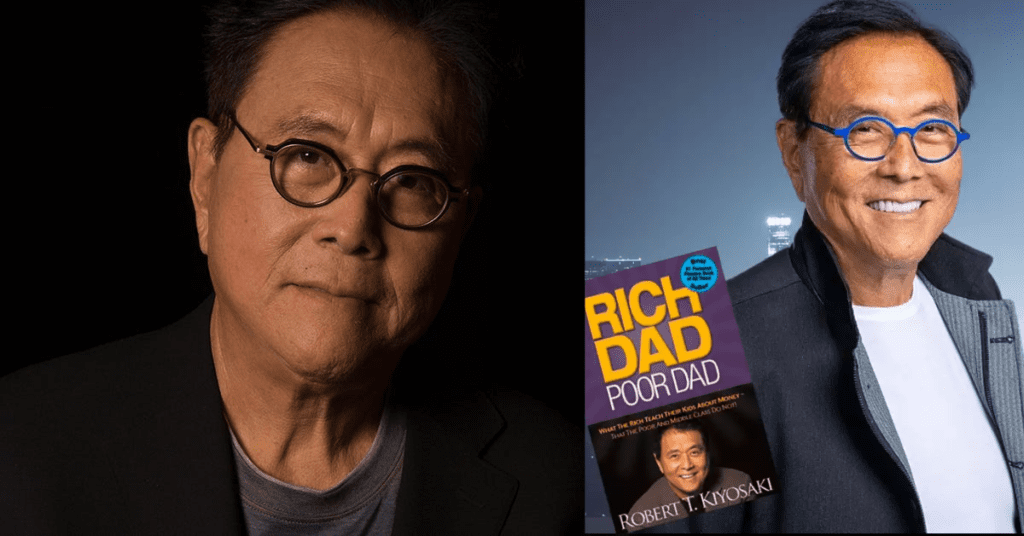

Robert Kiyosaki‘s bold statement, “All empires come to an end,” echoes through his recent interviews. According to him, it’s explosive, marking the end of the American empire. He predicts that when “cash” meets its demise, war follows. Kiyosaki acknowledges the gravity of his words, hoping he’s wrong. However, when the author of the renowned “Rich Dad, Poor Dad” series waves the red flag, it’s time to take notice, especially considering his accurate predictions of the fall of Lehman Brothers and the 2008 financial crash.

The Looming Crisis: Stock Market Teetering

Robert Kiyosaki‘s concerns extend to the current state of the stock market, which he believes is teetering on the edge of another 1930s-style crisis. While financially savvy individuals might weather the storm, he emphasizes that financial crashes tend to have varying impacts on different people.

Arm Yourself for the Storm: Kiyosaki’s Recommendations

-

Be Prepared With Gold

Buying gold, a trend Robert Kiyosaki has followed since 1972, is his first recommendation. Despite predicting gold’s climb to $2,100 per ounce in 2023 (now at $2,055), he still advocates for it. Why? Because he “doesn’t trust the Fed,” and historically, gold tends to hold its value during economic turbulence globally.

-

Buy Silver: The Biggest Investment Bargain

Silver is Robert Kiyosaki‘s second recommendation, dubbed “the biggest investment bargain right now.” It’s more affordable than gold, making it an accessible investment. You can acquire silver in various forms such as coins, jewelry, bullion, or ETFs tracking silver trends.

-

Invest In Bitcoin: People’s Money

Robert Kiyosaki has a unique take on traditional currencies, particularly the dollar. He often refers to dollars as “toilet paper” and declares, “I do not invest in anything you can print.” His choice? Bitcoin, which he sees as “people’s money.” Despite its volatile history, Kiyosaki predicts Bitcoin, could soar to $135,000.

-

Improve Financial Literacy: A Crucial Step

Whether you believe in Kiyosaki’s predictions or not, one of his crucial steps for reaching financial goals is to improve financial literacy. This advice aligns with the idea that understanding the financial landscape is key to navigating economic uncertainties.

-

Debt Philosophy: Assets Over Liabilities

Kiyosaki’s unique approach involves using debt strategically. He categorizes luxury vehicles like his Ferrari and Rolls Royce as liabilities, emphasizing his preference for using debt to purchase assets. This philosophy stems from his practice of saving in gold and converting earnings into precious metals.

Kiyosaki’s Billion-Dollar Debt Revelation

In a candid Instagram reel, Kiyosaki openly discusses being more than $1 billion in debt, emphasizing that it’s “not my problem.” He attributes this debt to his practice of saving gold and converting earnings into gold and silver, dating back to the detachment of the US dollar from the gold standard in 1971.

Debt Differentiation: Good Debt vs. Bad Debt

During the “Disruptors” podcast, Kiyosaki delves into the intricacies of debt, distinguishing between good and bad debt. Good debt, according to him, helps generate wealth, such as loans used to acquire income. He encourages leveraging debt in investments, particularly in real estate.

Bitcoin as a Hedge: Kiyosaki’s Ongoing Recommendations

Kiyosaki remains consistent in his recommendations, advising investors to buy gold, silver, and bitcoin. He even suggests considering bitcoin exchange-traded funds (ETFs), anticipating SEC approval. In the face of potential economic turmoil, he urges investors to get into BTC now, stressing its role in providing lifelong financial security and freedom.

DEFINITION of INSANITY is doing the same thing over and over again and expecting things to change. Our leaders, the 3 Stooges Biden as President, Yellin as Treasury Secretary and Powell as Fed Chairman are doing us a favor. They will drive us into Depression and War. Don’t be the…

— Robert Kiyosaki (@theRealKiyosaki) December 31, 2023

Conclusion: Navigating Uncertain Waters

In conclusion, Robert Kiyosaki’s warnings about the American empire’s end and the looming economic crisis should be taken seriously. While the future remains uncertain, his recommendations offer a proactive approach to financial preparedness. Whether you’re a seasoned investor or just starting, understanding the dynamics of assets, liabilities, and strategic debt use can be instrumental in safeguarding your financial well-being.

STALIN said: “It’s not who votes that counts. It is who counts the votes that counts.” America is dying. Our votes no longer count. Speak out. Fight back. Demand recounts now, not next election. Democracy is at stake and worth fighting for. Don’t let Communists steal our freedom

— Robert Kiyosaki (@theRealKiyosaki) November 13, 2022

Read: Energizing the Future: APA Corporation’s Game-Changing Acquisition Reshapes Energy Dynamics

Frequently Asked Questions (FAQs)

- Is Robert Kiyosaki predicting an economic depression?

Yes, Kiyosaki has expressed concerns about a potential economic depression, warning of a giant market collapse, war, and challenging times ahead.

- Why does Kiyosaki recommend buying gold?

Kiyosaki recommends buying gold because it has historically held its value during economic turbulence, making it a reliable asset in times of crisis.

- What is Kiyosaki’s view on Bitcoin?

Kiyosaki views Bitcoin as “people’s money” and a hedge against the deteriorating value of the US dollar. Despite its volatility, he predicts significant potential for its value to soar.

- How does Kiyosaki categorize luxury vehicles?

Kiyosaki categorizes luxury vehicles like his Ferrari and Rolls Royce as liabilities, emphasizing his debt philosophy that prioritizes using debt to acquire appreciating assets.

- Is financial literacy important according to Kiyosaki?

Yes, Kiyosaki stresses the importance of improving financial literacy as a crucial step toward reaching financial goals, especially in the face of economic uncertainties.

In these uncertain times, staying informed and making informed financial decisions is key to navigating the evolving economic landscape.